The company is expected to keep reporting losses over the next two fiscals. During the same period, the company’s loss per share is expected to come in at $0.98 compared to $0.12 during the previous-year quarter.įor fiscal 2023, COIN’s revenue is expected to decline 10.4% year-over-year to $2.86 billion, while it is expected to report a loss of $1.67 per share. Īnalysts expect COIN’s revenue for the first quarter of fiscal 2023 to decline 43.3% year-over-year to $663.80 million. These events have exposed systemic risk to the ecosystem and have driven political will favoring regulation.

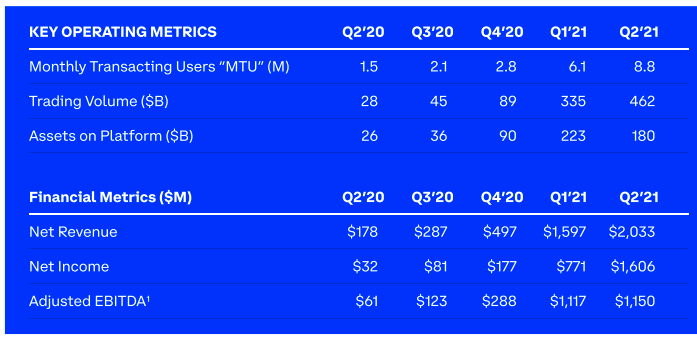

In addition to battling stronger-than-ever macroeconomic headwinds due to increasing interest rates, the cryptocurrency ecosystem has been rocked by scandals in fiscal 2022, such as the depegging of $LUNA and the collapse of FTX, which drove additional credit-related bankruptcies. The company offers financial accounts for retail crypto users, a liquid marketplace to institutions for crypto transactions, and technology and services for ecosystem partners.Īlthough COIN’s revenue has exhibited an 82% CAGR over the past three years, and its net assets have increased at a 234.8% CAGR over the same time horizon, the view from the windshield couldn’t be more contrasting to the image in the rearview mirror. The fintech company provides end-to-end financial infrastructure and technology for the global crypto economy. However, I think it might be wise to be skeptical about this rally because of the reasons explained throughout this article. The stock is trading above its 50-day and 200-day moving averages of $51.68 and $60.48, respectively.

( COIN ) has surged 82.7% year-to-date to close the last trading session at $64.67.

0 kommentar(er)

0 kommentar(er)